Earnings Per Share (EPS) is a key financial metric that indicates how much profit a company earns for each outstanding share of its common stock. It is one of the most widely used measures of a company’s profitability and is often used by investors to assess a company’s financial performance. EPS is calculated by dividing a company’s net income by the number of its outstanding shares.

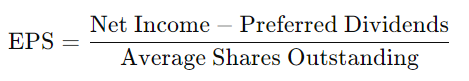

Formula for Earnings Per Share (EPS):

Where:

- Net Income: The total profit a company earns during a specific period, usually after taxes and expenses.

- Preferred Dividends: Dividends paid to preferred shareholders, which must be subtracted from net income to determine how much profit is available to common shareholders.

- Average Shares Outstanding: The weighted average number of common shares outstanding during the period.

Key Components of EPS:

- Net Income:

- This is the total profit of the company after deducting all expenses, including taxes, interest, and operational costs. It represents the company’s profitability for the reporting period (typically a quarter or a year).

- Preferred Dividends:

- If the company has issued preferred stock, it must pay dividends to preferred shareholders before calculating EPS. These preferred dividends are subtracted from net income to ensure that only the income available to common shareholders is considered.

- Average Shares Outstanding:

- This is the average number of common shares the company has in circulation during the period. If a company issues or repurchases shares during the period, the number of shares is averaged to reflect changes in outstanding shares over time.

Types of EPS:

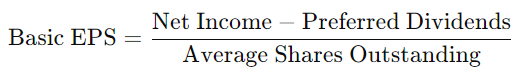

- Basic EPS:

- Basic EPS is the simplest form of EPS and is calculated using the basic number of shares outstanding (without accounting for any dilutive securities, such as stock options or convertible bonds). This is the most straightforward measure of profitability.

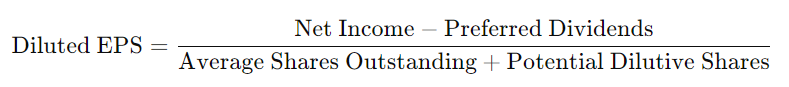

- Diluted EPS:

- Diluted EPS takes into account the potential dilution of shares that could occur if all convertible securities, such as stock options, convertible bonds, or warrants, were exercised. Diluted EPS provides a more conservative estimate of earnings because it assumes more shares are outstanding.

Diluted EPS=Average Shares Outstanding+Potential Dilutive SharesNet Income−Preferred DividendsDiluted EPS is often lower than Basic EPS because it includes the effect of potential additional shares, which would reduce the earnings available per share.

Diluted EPS=Average Shares Outstanding+Potential Dilutive SharesNet Income−Preferred DividendsDiluted EPS is often lower than Basic EPS because it includes the effect of potential additional shares, which would reduce the earnings available per share.

Importance of EPS:

- Indicator of Profitability:

- EPS is a fundamental indicator of a company’s profitability. A higher EPS suggests that the company is generating more profit per share of stock, making it more attractive to investors.

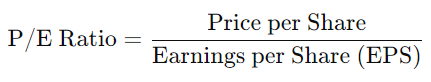

- Valuation Metric:

- EPS is a critical component in calculating the price-to-earnings (P/E) ratio, which is used to evaluate whether a stock is overvalued or undervalued compared to its earnings.

A high P/E ratio suggests that investors are expecting higher earnings growth in the future, while a low P/E ratio may indicate that the stock is undervalued or that the company’s future growth prospects are not as strong.

A high P/E ratio suggests that investors are expecting higher earnings growth in the future, while a low P/E ratio may indicate that the stock is undervalued or that the company’s future growth prospects are not as strong. - Comparison with Peers:

- EPS allows investors to compare the profitability of companies within the same industry or sector. Companies with higher EPS are generally considered more efficient at generating profits than their competitors.

- Impact on Stock Price:

- A company’s EPS directly influences its stock price. Positive growth in EPS is often rewarded by the market with higher stock prices, while declining EPS can lead to a decrease in stock value.

Limitations of EPS:

- Doesn’t Account for Debt:

- EPS does not take into account a company’s debt levels, which can be a significant factor in its financial health. A company with high debt might have a high EPS but face financial risks due to its debt obligations.

- Can Be Manipulated:

- Companies can engage in practices such as stock buybacks to artificially increase EPS by reducing the number of shares outstanding. This may create the appearance of improved profitability without any real increase in net income.

- Doesn’t Consider Cash Flow:

- EPS is based on accounting earnings, not cash flow. A company might report high earnings but have poor cash flow, which can lead to financial issues. Investors should also consider cash flow when evaluating a company’s financial health.

- One-Time Events:

- EPS may be impacted by one-time events, such as the sale of a large asset or a lawsuit settlement, which can inflate or deflate earnings. It’s important to look at adjusted EPS, which excludes such one-time events, for a clearer view of ongoing profitability.

Adjusted EPS:

Some companies report adjusted EPS, which removes one-time or non-recurring items (e.g., asset sales, restructuring costs) from net income. This provides a clearer picture of the company’s core operations and profitability.