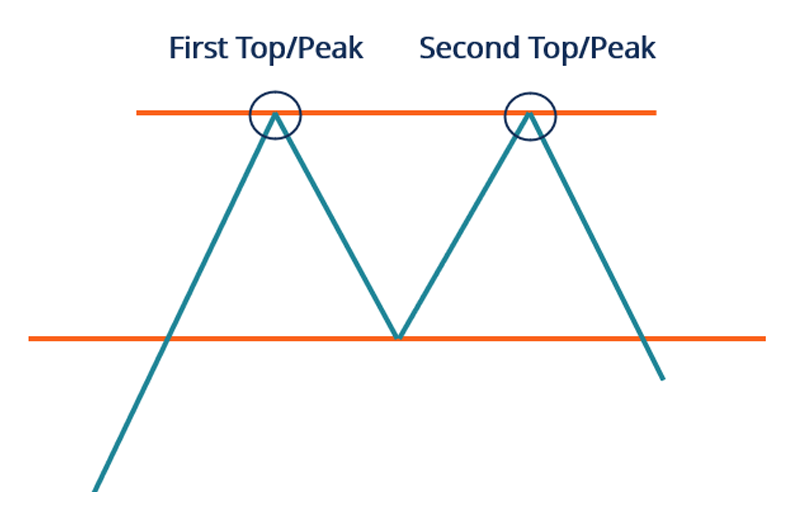

A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. It is confirmed once the asset’s price falls below a support level equal to the low between the two prior highs.

- A double top is a bearish technical reversal pattern.

- It is not always easy to spot because there needs to be a confirmation with a break below support.

- While a double top is a bearish signal, a double bottom is a bullish signal.

- Top tops usually have an upswing, initial peak, trough, second peak, and neckline.

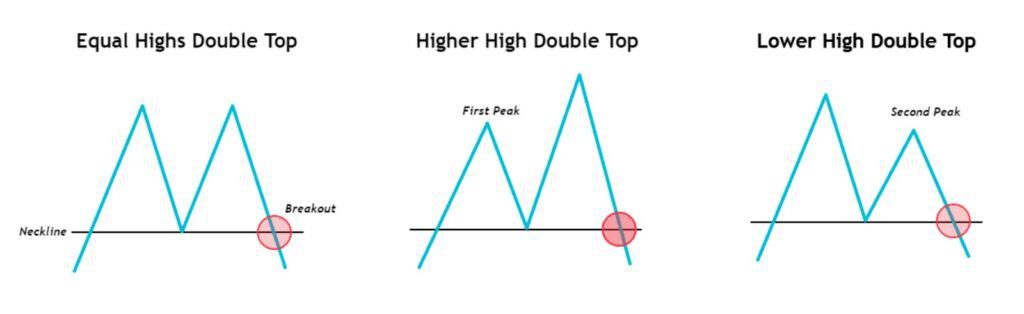

Types of Double Top

The Equal Highs, Classic Double Top

Equal highs double tops refers to the two peaks being incredibly close at similar heights. This will appear like a classic ‘M’ shape pattern.

The Unequal Highs Double Tops

The unequal highs double tops are ‘M’ patterns with forms with peaks at different highs. These unequal highs double tops are stronger reversal signals, as they often indicate a liquidity grab.

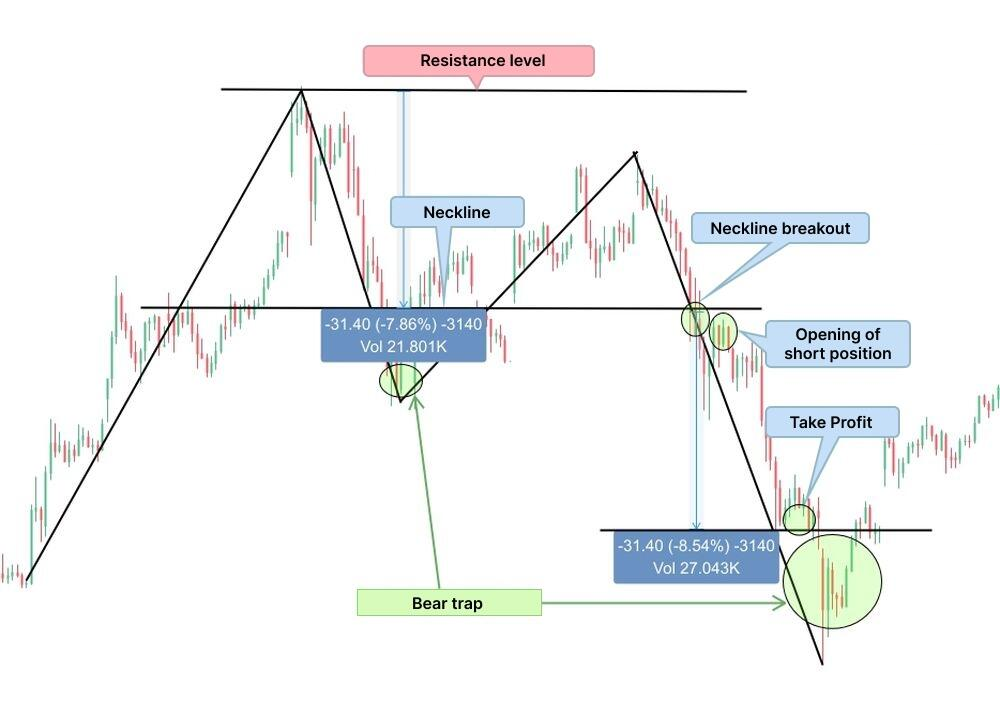

How to trade with Double Top?

The safest approach is to wait for a confirmed breakdown of the ‘M’ formation, marked by a candle closing below the neckline. Then, initiate a short trade at the close of the candle, or wait for further confirmation on a retest of the neckline.

It’s very important to wait for the break of the neckline, because you are trading against the previous trend. The price could simply be consolidating before another trend higher.

Double top in Tesla chart

A double top is formed after an uptrend in the chart. The bears managed to reverse the price down after the second local high and break out the support level.

Pay attention to the bear traps in the chart. When trading double tops, you need to be vigilant not to use false signals.

Merits of Double Top Pattern

- A double-top pattern portrays a cue for a possible change in trend from an uptrend to a downtrend.

- The two consecutive tops can be used by traders as a benchmark to establish stop-loss orders and profit motives.

- It provides a good entry point for traders to begin short positions at the breakpoint of the neckline.

- The height of the tops can be used to predict profit targets and give traders a distinct moment to exit.

- In various ways, the double top could be more predictable and reliable than other strategies.

Demerits of Double Top Pattern

- This pattern is not infallible.

- It can occasionally generate false signals.

- There could be subjectivity involved in recognising a double-top pattern.

- It can be hard to specify the entry and departure locations or establish the pattern’s target level due to variability.