Dividend analysis is the evaluation of a company’s dividend policy, history, and payout practices to assess its financial health, stability, and attractiveness to income-focused investors. Dividends represent the portion of a company’s profits that are distributed to shareholders, typically on a regular basis (quarterly, semi-annually, or annually). Investors and analysts use dividend analysis to determine the sustainability and growth potential of dividends, which can be an important factor in deciding whether to invest in a stock, especially for long-term or income-seeking investors.

Key Concepts in Dividend Analysis:

1. Dividend Yield

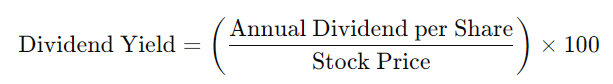

- Definition: Dividend yield is a financial ratio that shows the percentage return on a stock’s current price paid out as dividends. It is calculated as:

- Importance: A higher dividend yield may indicate that a company provides substantial income relative to its share price. However, excessively high yields could also signal underlying financial issues (e.g., a declining stock price).

2. Dividend Payout Ratio

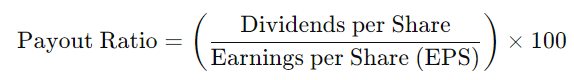

- Definition: The dividend payout ratio measures the proportion of a company’s net income that is paid out to shareholders as dividends. It is calculated as:

- Significance: This ratio helps investors assess the sustainability of a company’s dividend payments. A low payout ratio suggests that the company retains more earnings for growth, while a high payout ratio could indicate that a company is returning most of its earnings to shareholders.

A payout ratio below 60% is often seen as healthy, while a ratio above 100% might indicate that the company is paying more in dividends than it earns, which could be unsustainable.

3. Dividend Growth Rate

- Definition: The dividend growth rate is the annualized percentage increase in dividends per share over time. It reflects the company’s ability to grow its dividends consistently.

- Importance: Consistent dividend growth is a positive indicator of a company’s financial health and management’s confidence in future earnings. Companies that regularly increase dividends are attractive to long-term investors looking for both income and capital appreciation.

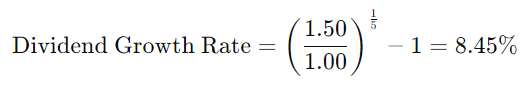

- Example: If a company’s annual dividend was $1 five years ago and it has increased to $1.50 today, the dividend growth rate over the period would be:

4. Sustainability of Dividends

- Free Cash Flow (FCF): Investors often analyze free cash flow to assess a company’s ability to pay and sustain dividends. FCF represents the cash generated by the company after capital expenditures, which can be used for dividends, debt repayment, or reinvestment.

- Debt Levels: High levels of debt can put pressure on a company’s ability to continue paying dividends, especially in times of economic downturns or rising interest rates. A company with high debt and aggressive dividend policies may face risks in sustaining payouts.

5. Dividend Coverage Ratio

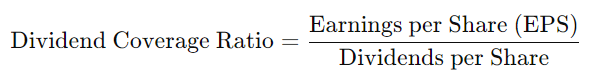

- Definition: The dividend coverage ratio measures the number of times a company can pay its dividends from its net income. It is calculated as:

- Significance: A higher coverage ratio suggests that the company has enough earnings to comfortably cover its dividend payments. A ratio of 2 or higher is considered strong, while a ratio below 1 may indicate that the company is paying out more than it earns, which is unsustainable in the long term.

6. Dividend Policy

- Stable Dividend Policy: Many companies follow a stable dividend policy, where they aim to pay a consistent and steadily growing dividend over time, regardless of short-term earnings volatility. Investors value stability because it provides a predictable income stream.

- Residual Dividend Policy: Under this policy, a company pays dividends only after meeting its capital expenditure and reinvestment needs. This approach may result in more variable dividend payments.

- Target Payout Ratio: Some companies set a target payout ratio, where they aim to pay a certain percentage of earnings as dividends. This allows for flexibility based on earnings performance while maintaining a commitment to return cash to shareholders.

7. Types of Dividends

- Cash Dividends: The most common form of dividends, where companies distribute cash to shareholders. Cash dividends are typically paid on a quarterly or annual basis.

- Stock Dividends: Instead of paying cash, companies may issue additional shares to shareholders. Stock dividends increase the number of shares owned without changing the overall value of the investment.

- Special Dividends: These are one-time dividends paid out when a company has excess cash or experiences a financial windfall (e.g., from asset sales). Special dividends are not part of the regular dividend schedule.

- Dividend Reinvestment Plans (DRIPs): Companies may offer shareholders the option to reinvest their dividends into additional shares of the company, often without brokerage fees. This can be an attractive option for long-term investors looking to compound their returns.

8. Dividend Aristocrats

- Definition: Dividend Aristocrats are companies in the S&P 500 that have increased their dividends for at least 25 consecutive years. These companies are often seen as stable, well-established firms with strong cash flow and a commitment to returning capital to shareholders.

- Significance: Dividend Aristocrats are highly regarded by income investors for their reliability in providing regular and growing dividend payments, even during economic downturns.

9. Total Return and Dividends

- Total Return: Investors often look at the total return, which includes both capital gains (the increase in the stock price) and dividends. While dividends alone provide income, combining them with stock price appreciation offers a comprehensive view of an investment’s performance.

- Importance: For long-term investors, dividends can represent a significant portion of total return, especially in low-growth or flat markets.

10. Tax Considerations

- Qualified Dividends: In many countries, qualified dividends are taxed at a lower capital gains tax rate compared to ordinary income tax rates. Investors should consider the tax treatment of dividends when evaluating dividend-paying stocks.

- Dividend Taxes: Dividends may be subject to withholding tax, depending on the investor’s country of residence and tax laws. It’s important for investors to account for taxes when calculating their net dividend income.