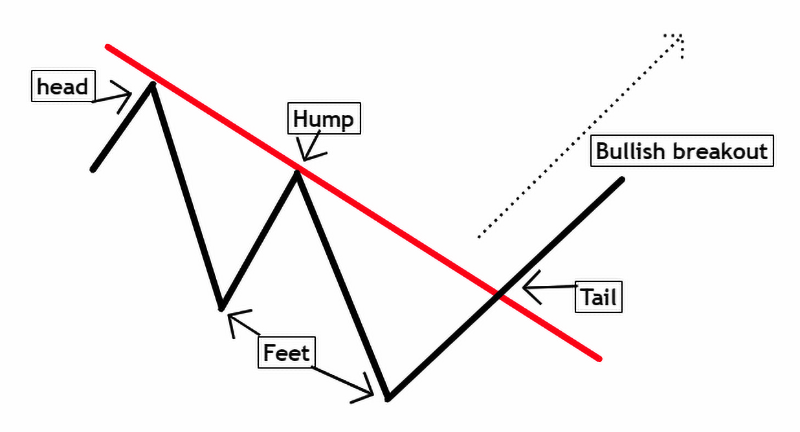

A “bullish dragon pattern” in technical analysis refers to a candlestick formation on a chart that signals a potential reversal from a downtrend to an uptrend, often resembling a “W” shape, indicating a bullish signal after a period of price decline; it suggests that the price is likely to move upwards following the pattern’s completion.

Components of a dragon pattern

There are four important components of a dragon.

- Head

- Feet

- Hump

- Tail

1. Head

The head of the dragon is the begging of the dragon pattern. It indicates the prior trend. In the case of a bullish dragon, the prior trend is bearish. On the other hand, a bearish dragon forms above a prior bullish trend.

2. Feet

There are two feet of the dragon. The positioning of the feet is so the second foot is a little below the first foot. If the second foot is bigger in size, the reversal is usually greater.

In the case of a bearish dragon, feet are formed in the inverted position as the dragon’s body is reversed.

3. Hump

It is a slight rise in the prices compared to the feet of the dragon. It is located between two feet but at a higher level in the case of a bullish dragon. In the case of a bearish dragon, the hump is below the feet.

4. Tail

In the case of a bearish dragon, a bearish breakout takes place after the tail of the dragon. In this case, the number of sellers dominates a market and prices begin to face a fall.

It is the last point of the Dragon’s body. It is the point where a breakout in the market takes place. In the case of a bullish dragon, the price begins to rise after the formation of a tail. The market begins to take new highs, and the bullish sentiment takes place. It is the time when the number of buyers begins to take over the market.

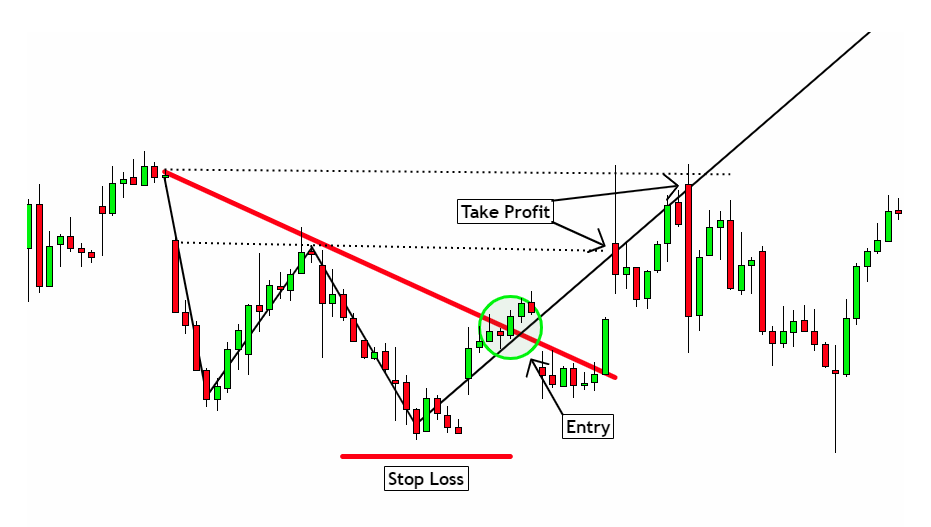

Trading strategy for a bullish setup

The trading strategy for a bullish setup is divided into the following steps.

- Entry

- Take profit

- Risk management

Entry

After the formation of the second foot of the dragon, the bullish dragon is confirmed. The best time to enter a trade is once the bullish sentiment of the market begins to appear.

To find the best entry point, draw a trendline that passes through the head, hump, and the point after the second foot. This point forms an ideal entry point. Later to this entry point, the prices take a slight dip, and the bullish break out takes place.

Take profit

Two options exist for taking the profit if dealing with a bullish dragon pattern. Suppose you are more interested in short trading. you can take a profit just above the tail of the dragon, equivalent to the head or equivalent to the Hump, when prices begin to rise.

In a long trade, you have to wait for a breakout in the prices. Usually, the prices take a spike after a bullish dragon appears. The more patient and professional traders wait for the full spike to take a significant profit.

Risk management

Risk management is a vital step when trading a bullish reversal dragon. I recommend you place the stop loss below the second foot of the dragon. It will significantly protect your potential losses if the dragon doesn’t behave as usual and the price reverses.