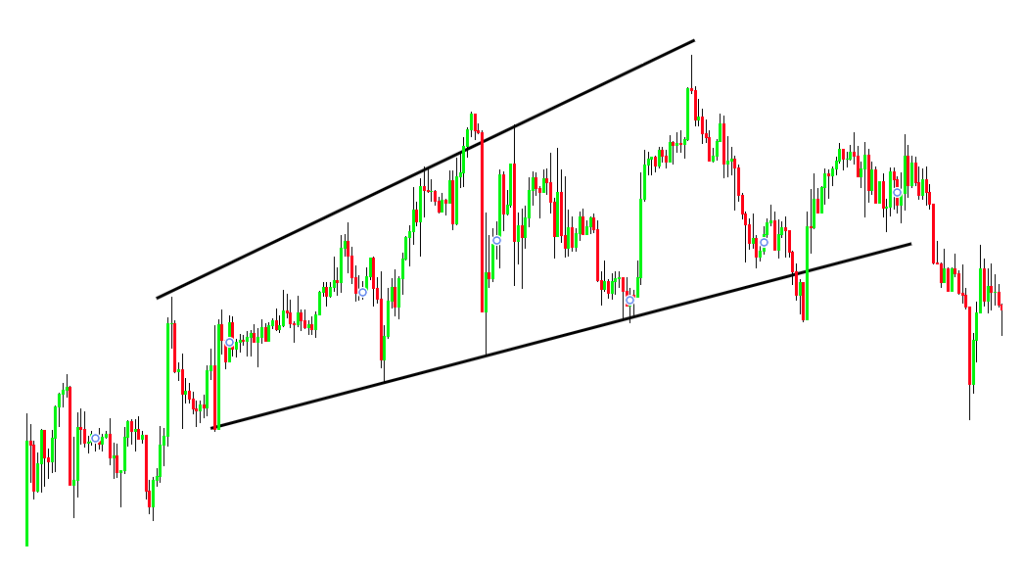

Ascending Broadening Wedge is a bearish trend reversal chart pattern consisting of expanding wave with two trendlines in an upward direction.

The upper trendline acts as the resistance line and the lower trendline act as the support line. This chart pattern shows a bearish signal with a high winning rate. That’s why traders widely use ascending broadening wedge pattern.

How to identify ascending broadening wedge pattern?

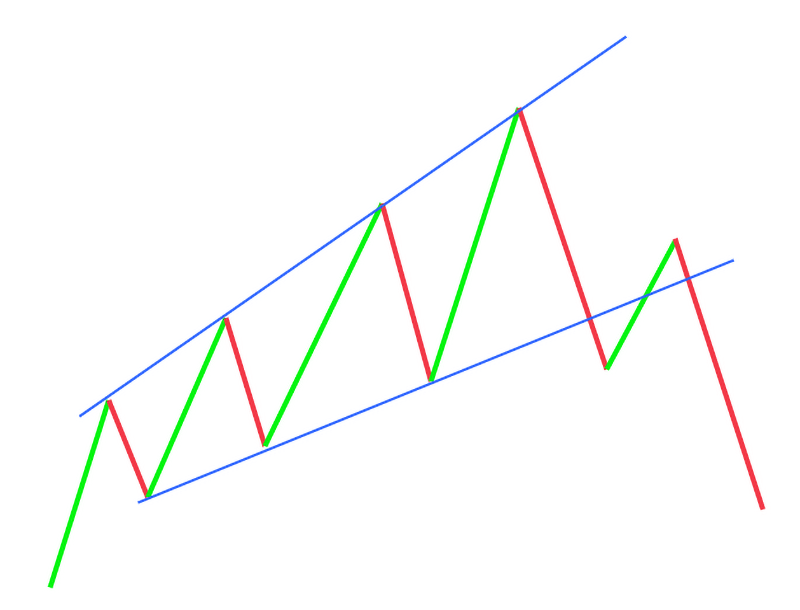

Wedge is a structure that has one thin and one thick end. As the name suggests, it expands with time from the narrow end to the wide end.

- To identify this pattern on the chart, follow the following steps:

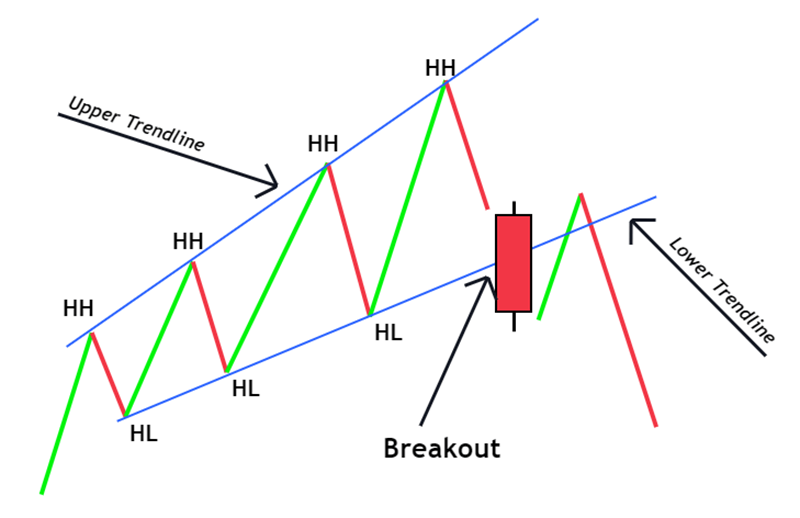

- Find the wave’s starting point, and the wave should make higher highs and higher lows.

- Each upcoming wave should be greater in size than the previous wave. It will make a broadening wedge-like structure.

- Draw two trendlines meeting the swing high and swing low points.

- There must be at least three waves within ascending broadening wedge pattern.

What does ascending broadening wedge pattern tell traders?

The structure of this chart pattern shows that price is slowly moving in a bullish direction and breaking the key levels created by sellers. The expansion of the wave indicates that the momentum is increasing in the market with time. And soon the market will take a big decision.

How to identify trendline breakout?

Price will break the lower trendline. Many false breakouts can happen, but you should always show patience.

There is a simple and effective method to filter false breakouts of the trendline.

The breakout of trendline should always happen with a big bearish candlestick. A big candlestick means a candle with more than 70% body to wick ratio. Big body and small shadows. It shows the enormous momentum within less time at the support line.

Example

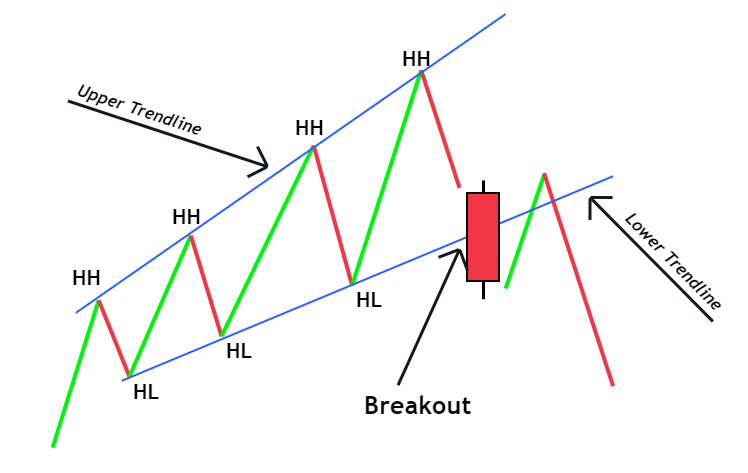

Short entry: The point at which the price, broke the lower trendline.

Back of the wedge: The point where the stop loss would move above the new resistance area.

Profit Target: When we take into account the height of the back of the wedge and lengthen that distance down from the entry,it is the profit target.

Stop Loss: It has to be placed above the higher trendline while trading a ascending, broadening wedge.