Valuation techniques are methods used to determine the current worth or intrinsic value of an asset, investment, or company. In finance, these techniques are essential for making investment decisions, assessing companies for mergers or acquisitions, determining stock prices, or evaluating potential returns. The goal is to arrive at a value that reflects the asset’s or company’s true worth based on its future earning potential, financial health, and market factors.

Here are some commonly used valuation techniques:

1. Discounted Cash Flow (DCF) Analysis

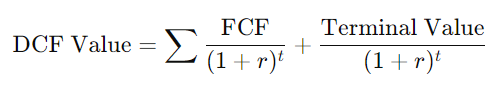

- Overview: DCF is one of the most popular valuation techniques. It estimates the present value of an asset by calculating the future cash flows it is expected to generate, and then discounting those cash flows back to their present value using a required rate of return (discount rate).

- How It Works:

- Step 1: Estimate the future free cash flows (FCF) of the company or asset over a certain period (usually 5–10 years).

- Step 2: Determine the terminal value, which represents the value of cash flows beyond the projection period.

- Step 3: Discount these future cash flows and terminal value back to the present using a discount rate (often the company’s weighted average cost of capital, or WACC).

- Formula:

- Where:

- FCF = Free Cash Flow

- rr = Discount Rate

- tt = Time (years)

- Usage: This technique is best for companies with predictable and stable cash flows.

2. Comparable Company Analysis (Comps)

- Overview: Also known as “relative valuation,” this technique compares the company to similar firms in the same industry or sector. It assumes that companies with similar characteristics should be valued similarly.

- How It Works:

- Step 1: Identify a set of comparable companies based on factors like size, industry, or business model.

- Step 2: Calculate relevant financial ratios (e.g., P/E ratio, EV/EBITDA, P/S ratio) for the comparable companies.

- Step 3: Apply the average or median of these ratios to the company being valued to estimate its value.

- Usage: This method is often used for valuing publicly traded companies where market data is available, or in mergers and acquisitions (M&A) transactions.

3. Precedent Transactions Analysis

- Overview: This technique involves analyzing past mergers, acquisitions, or transactions involving similar companies to derive a valuation multiple. It is similar to comparable company analysis, but it focuses on actual transactions that have occurred in the past.

- How It Works:

- Step 1: Identify precedent transactions (deals involving companies with similar business models, industries, or sizes).

- Step 2: Analyze the valuation multiples used in those transactions (e.g., P/E ratios, EV/EBITDA multiples).

- Step 3: Apply the relevant multiple from the precedent transactions to the company or asset being valued.

- Usage: Precedent transaction analysis is typically used in M&A and is especially useful for determining the market value in the context of acquisition offers.

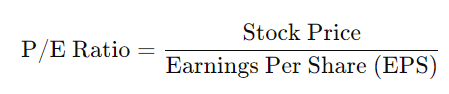

4. Price-to-Earnings (P/E) Ratio

- Overview: The P/E ratio compares a company’s stock price to its earnings per share (EPS), helping investors assess whether the stock is overvalued or undervalued relative to its earnings.

- How It Works:

- Formula:

-

- The P/E ratio can be compared to the P/E ratios of similar companies or to historical P/E ratios of the same company.

- Usage: Widely used for valuing stocks of publicly traded companies, particularly those with consistent earnings. A higher P/E ratio indicates that investors expect future growth, while a lower P/E ratio may suggest the stock is undervalued or faces challenges.

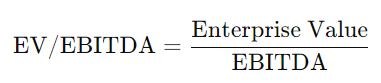

5. Enterprise Value (EV) to EBITDA

- Overview: This ratio compares the enterprise value (EV) of a company to its earnings before interest, taxes, depreciation, and amortization (EBITDA). EV/EBITDA is useful because it measures a company’s ability to generate earnings from its operations without the influence of capital structure (debt/equity) or non-cash accounting items.

- How It Works:

- Formula:

- Enterprise Value (EV) is calculated as: EV=Market Capitalization+Debt−Cash

- Usage: It is commonly used in M&A and is a good measure of a company’s operational profitability. Lower EV/EBITDA multiples indicate undervaluation, while higher multiples indicate overvaluation.

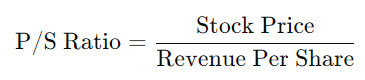

6. Price-to-Sales (P/S) Ratio

- Overview: The P/S ratio compares a company’s stock price to its revenue per share. This valuation technique is especially useful for companies that are not yet profitable or have volatile earnings.

- How It Works:

- Formula:

- It can be compared to the P/S ratios of similar companies in the same industry.

- Usage: The P/S ratio is frequently used for valuing early-stage or growth companies that have revenue but not yet profitability.

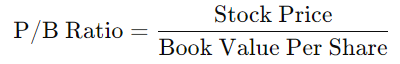

7. Book Value (Price-to-Book Ratio)

- Overview: The price-to-book (P/B) ratio compares the market value of a company’s stock to its book value, which is its net asset value (assets minus liabilities) as reported on the balance sheet.

- How It Works:

- Formula:

- Usage: This method is particularly useful for industries with significant tangible assets, such as manufacturing or real estate. A P/B ratio below 1 can indicate that a company is undervalued relative to its net assets.

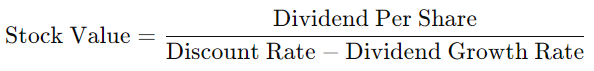

8. Dividend Discount Model (DDM)

- Overview: DDM values a company based on the present value of its future dividend payments. It is based on the idea that the value of a stock is equal to the sum of its future dividend payments, discounted back to their present value.

- How It Works:

- Formula (Gordon Growth Model):

- This model assumes a constant growth rate for dividends.

- Usage: It is commonly used for valuing dividend-paying stocks, especially for companies with a consistent dividend history and predictable growth.

9. Sum-of-the-Parts (SOTP) Valuation

- Overview: SOTP involves valuing each business unit or division of a company separately and then adding them together to determine the overall company value.

- How It Works:

- Value each segment using an appropriate valuation method (e.g., DCF, P/E, EV/EBITDA) and then aggregate the values.

- Usage: It is typically used for conglomerates or companies with diverse operations in different sectors. This method helps to highlight hidden value that may not be evident from consolidated financial statements.

10. Replacement Cost Valuation

- Overview: This technique estimates the cost to replace a company’s assets. It’s based on the idea that a company’s value is equal to the cost of replacing its existing assets with new ones.

- Usage: This is commonly used for asset-heavy industries like manufacturing, real estate, and infrastructure. It is useful when a company’s value is closely tied to the physical assets it owns.